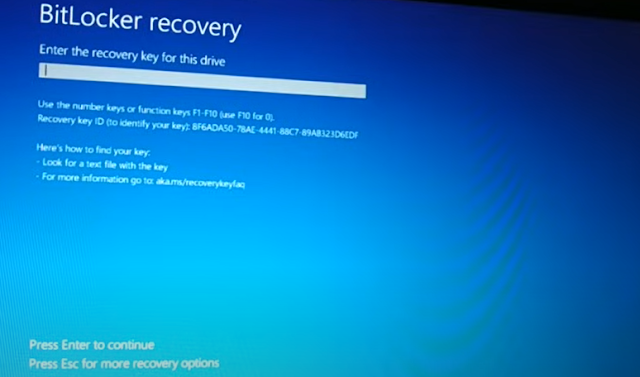

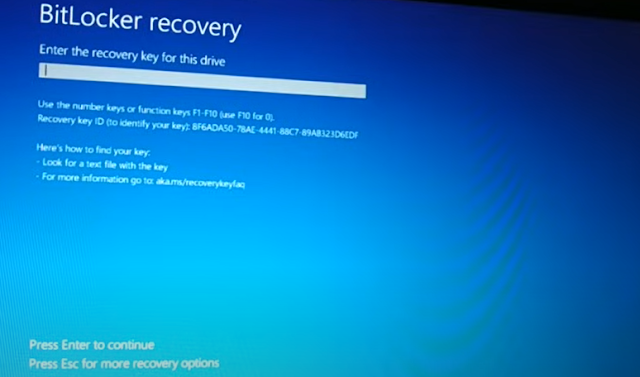

Forgot bit locker pin, forgot bit locker recovery key, 5 Easy ways to fix

|

Payment

gateway Name |

Account

& Card maintenance - charge |

Transfer

in between same wallet - charge |

Transfer

from wallet to local bank account - charge |

Receive

from market place to wallet - charge |

|

1.

Payoneer |

Annual account fee = 29.95 USD (If you have received less than 2,000.00 USD (or

equivalent) in payments per Year) Annual card fee: First card = 29.95 USD Additional cards in any currency = Free |

FREE EUR, USD, GBP, and more |

SWIFT (wire) bank transfers fee = 15 USD (If

withdraw amount is less than 750.00 USD) If Withdrawing minimum of 750.00 USD or higher, fee

= 2.00% of transaction amount For EUR, GBP, fee = 2.00% of transaction amount, for

any amount you withdraw. |

Free for payments of 100.00 EUR or higher 0.90 EUR for payments below 100.00 EUR Full payment amount for payments below 0.90 EUR Free for payments of 100.00 GBP or higher 0.70 GBP for payments below 100.00 GBP Full payment amount for payments below 0.70 GBP 1.00% of payment amount Minimum fee of 1.00 USD Full payment amount for payments below 1.00 USD Credit/debit card = 3.00% of transaction amount ACH Bank Debit = 1.00% of transaction amount |

|

1.

Skrill |

1st card application = 10 EUR Card annual fee = 10 EUR Free for personal use as long as you log in or make a transaction at

least every 6 months. Otherwise a service fee of EUR 5.00 (or equivalent) will be deducted

monthly from your account. |

Skrill to Skrill Money Transfers = 2.99% |

SWIFT (wire) bank transfers fee = 4.66 GBP, (5.50 EUR) |

Free (Currency conversion charge = 3.99%, If currency conversion

required.) |

|

2.

PayPal |

Annual Account Fee = Free |

Sending Money

for Goods and Services = 4.49% of transaction amount in USD |

PayPal linked bank account = No Fee (If no currency

conversion is required) |

Receiving Money for Goods and Services = 4.49% of

transaction amount in USD |