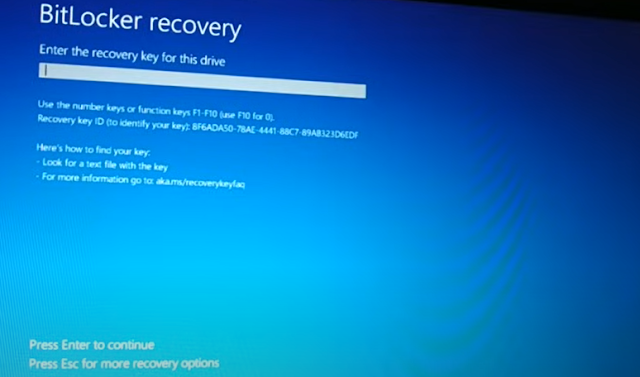

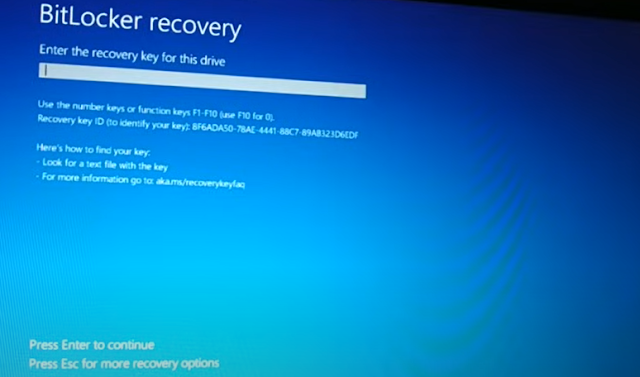

Forgot bit locker pin, forgot bit locker recovery key, 5 Easy ways to fix

The NPV function in Excel is a financial function used to calculate the net present value of an investment based on a series of cash flows and a discount rate. It takes into account the time value of money, which means that a dollar received in the future is worth less than a dollar received today.

The formula for NPV is as follows: NPV(rate, value1, value2, ..., [value n])

Where,

· rate: the discount rate to be applied to the cash flows.

· value1, value2, ...: the cash flows in each period, listed in chronological order.

The NPV function sums the present values of each cash flow, where the present value of each cash flow is calculated as: PV = FV / (1 + rate)^n

where:

· FV = future value of the cash flow

· n = number of periods from the present to the future value

For example, we have a data for cash flows for five years. The required rate of return is 10%. We can calculate the net present value by using the formula:

The function will return 241.14 whichis the NPV of the investment. Note that the NPV function assumes that the cash flows are evenly spaced and that the first cash flow occurs one period from the present.